Table of Contents

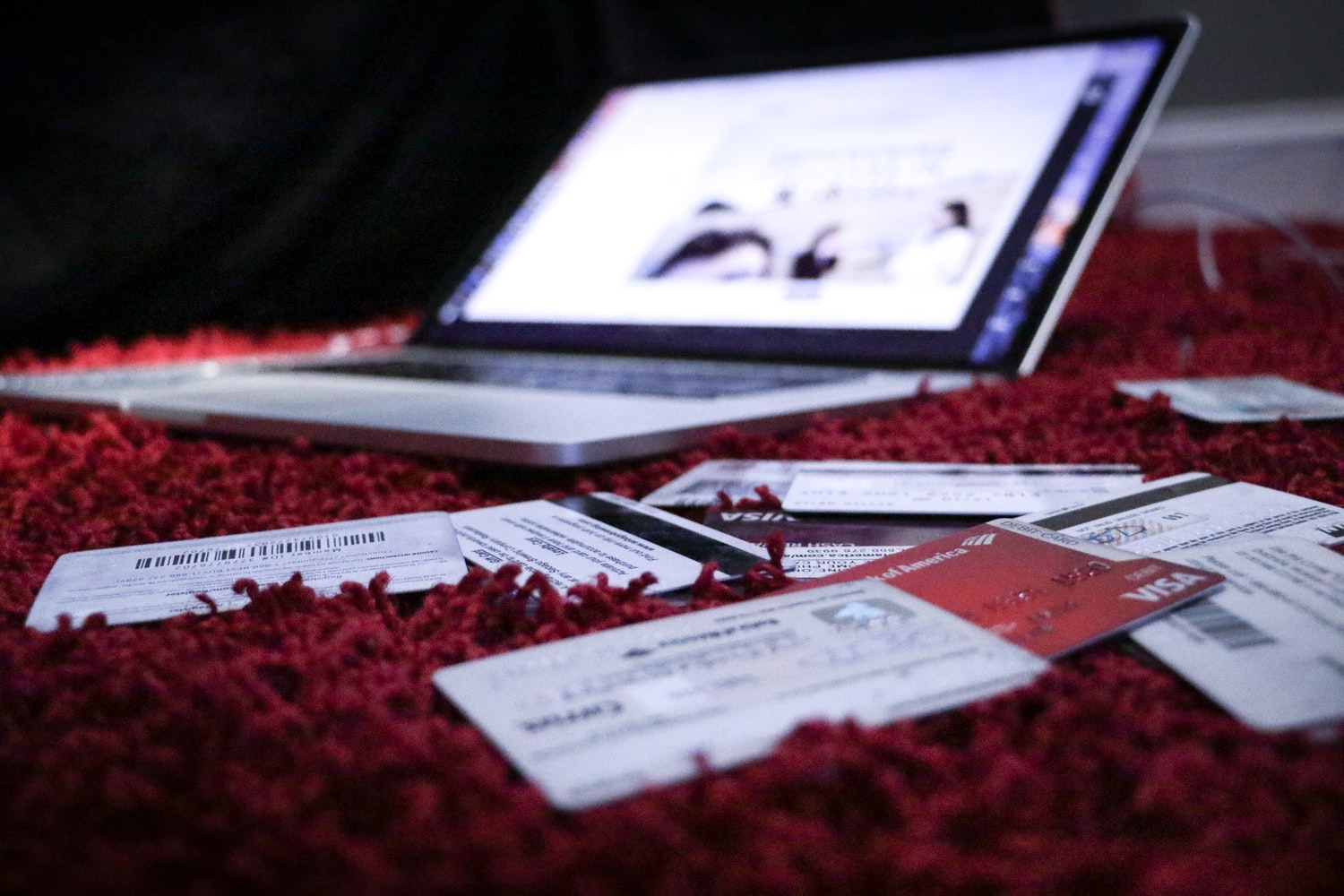

Have you heard about debt relief services? If yes, you can go straight to reading their benefits. We have found four basic pros, although there are actually many more. If not, we will tell you in brief.

Debt relief services help you with your loans. They deal with each situation individually and facilitate relief: they agree with top banks on extending payment deadlines or lowering interest rates, for example. In this way, they act as a third party between you and the lender and work in your favor.

And now let’s look specifically at the benefits.

You Don`t Do Everything On Your Own

Debt relief sounds like something you can do yourself. It really is: you don’t have to go to someone else here. But when you take over, there’s a lot to deal with. For example, the legal nuances and peculiarities of banks.

When you use debt relief services, specialists are taken on the case. They already have experience and knowledge, so the process is carried out many times faster. Besides, there is much less risk that something will go wrong.

Specialists Review Every Situation Individually

As we said above, debt relief specialists have extensive experience. It allows them not only to own a huge amount of information but also to know how to apply it better. When you come to them with your problem, they develop a plan to help you from scratch. In doing so, they take into account similar situations in the past to create it. In the end, they are able to find a compromise between proven and innovative ways. And that compromise is ideal for your situation because it’s found specifically for that situation.

You Have a Few Debt Relief Options

Debt relief is possible in several ways. It is possible to extend the maturity of the debt and thus reduce the monthly payment. It is possible to file for bankruptcy and thus declare that you are unable to pay the debt. You can combine debts from different banks into one. Or you can even get some of the debt forgiven.

One of the advantages of a debt relief service is that all options are considered, and the best option is chosen together with you. You don’t have to determine in advance what’s right for you, and you don’t have to choose the right company by this criterion.

The First Consultation is Free

When you are already in debt, it is scary to pay for a service without knowing how useful it will be for you. Part of the answer to this question is a free consultation. Not all companies offer this option, but some have it.

At the free consultation you get the opportunity to preliminarily deal with your situation and, if the quick conclusions of a specialist will suit you, then continue to work for a fee. It is not yet a guarantee of quality, but a clear example of how the company can help you.

Author Profile

- Blogger by Passion | Contributor to many Business Blogs in the United Kingdom | Fascinated to Write Blogs in Business & Startup Niches |

Latest entries

FinanceFebruary 7, 2026The Main Types of Online Fundraising Used by Charities

FinanceFebruary 7, 2026The Main Types of Online Fundraising Used by Charities BusinessJanuary 9, 20266 Fastest Cash House Buyers in the UK 2026

BusinessJanuary 9, 20266 Fastest Cash House Buyers in the UK 2026 BusinessDecember 12, 2025The Smart SME’s Guide to Future-Proofing Physical Assets

BusinessDecember 12, 2025The Smart SME’s Guide to Future-Proofing Physical Assets FinanceOctober 28, 2025How to Measure the ROI of Your Promotional Product Campaigns?

FinanceOctober 28, 2025How to Measure the ROI of Your Promotional Product Campaigns?