If you don’t have the patience for it, filing your tax return in your home country can be a confusing endeavor, more so when you’re a U.S. expatriate.

As a U.S. citizen living abroad, you’ll need to do some research to ensure that you don’t miss a single crucial step in the filing process.

You’ll need to have a good understanding of the laws covering U.S. tax returns for expats and any exceptions that may apply to you.

After all, having comprehensive knowledge about U.S. tax return for expats will help ensure that you’re not getting taxed twice and commit mistakes that will get you penalized.

In this post, we’re going to take a look at the four crucial things that expats need to know about U.S. tax return to help make the filing process a bit easier for you.

Let’s get right to it.

1. All U.S. Citizens living overseas are still required to file an expat tax return.

The U.S. tax system taxes you based on your citizenship, rather than your residence.

This means that if you’re an American expat – including Green Card holders – you’re still required to report your worldwide income and file your U.S. tax return, regardless of where you live.

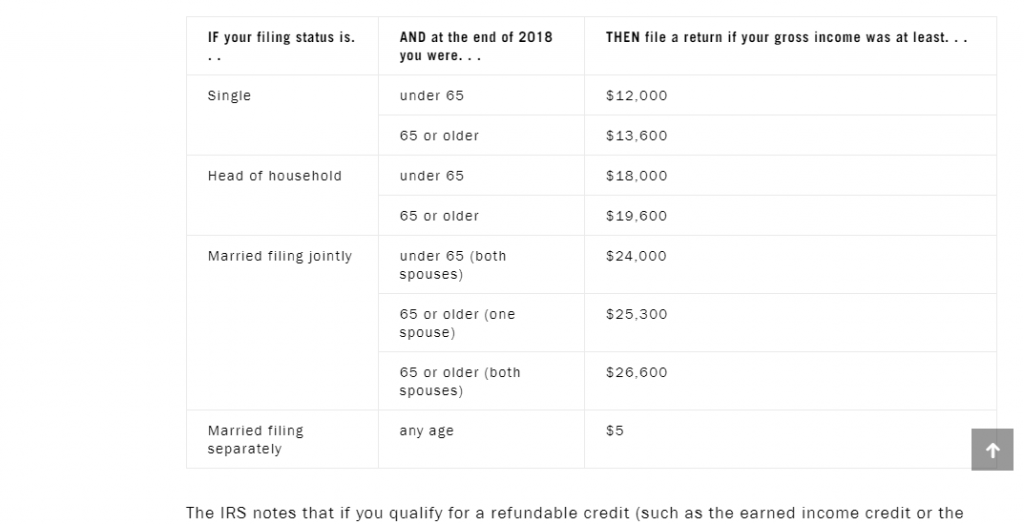

Your income will include your salary or wages from U.S. and non-U.S. sources, rental income, dividends, and interest, plus, regardless of filing status, the threshold is $400 if you’re self-employed.

The current draft Form 1040 Instructions lists the new minimum thresholds, as shown in the screenshot below.

Image Source: ExpatTaxProfessionals

Also, if you’re eligible for specific refunds and credits, you might want to consider still filing even if you don’t have to.

Other situations like special taxes will also subject you to filing requirements.

Although filing your tax return is required, most expats won’t end up paying anything.

For instance, there are applicable exclusions that let taxpayers deduct to more or less $100,000 from their taxable income, however, you will need to continue filing your tax return to become eligible for such deductions.

Failing to file your annual U.S. expat tax could leave you with severe penalties.

2. Expats can file for an extension.

The due date for filing U.S. expats (including serving naval and military services overseas) tax return is April 15, but you’ll get an automatic extension of two months if you live outside of the U.S. on that date.

However, you still need to pay your federal income tax on the regular due date since failing to do so will result in interest charges until the date of your payment.

You will also be given another six-month extension if you can’t complete your filing by the regular due date, but again, you’ll still need to pay your taxes on time.

This six-month extension, however, needs to be requested, so you’ll need to file Form 4868 and show your estimated tax liability based on your available details.

Keep in mind, though, that if you are under court order to file your expat tax return by the regular due date, or if you want the IRS to estimate your tax for you, then you will not be eligible for the six-month extension.

Also, remember to take note of the difference between fiscal and calendar year deadlines, so you don’t mix up due dates and end up with penalties and fines.

3. Required forms and documents.

Aside from filing and paying your U.S. expat tax return on time, you will also need to ensure that you have gathered all the necessary documents, including documentation of all your income.

Documents such as your stocks and bonds, retirement accounts, and foreign bank accounts, among other things, are some of the requirements that you will need to submit.

For instance, if you live in a country that bases its tax filing on a fiscal calendar, then you’ll need to keep your end-of-year pay stub so you can compute your earnings for the past calendar year.

You will also need to prepare the necessary forms ahead of your filing. Here are a few that you need to secure.

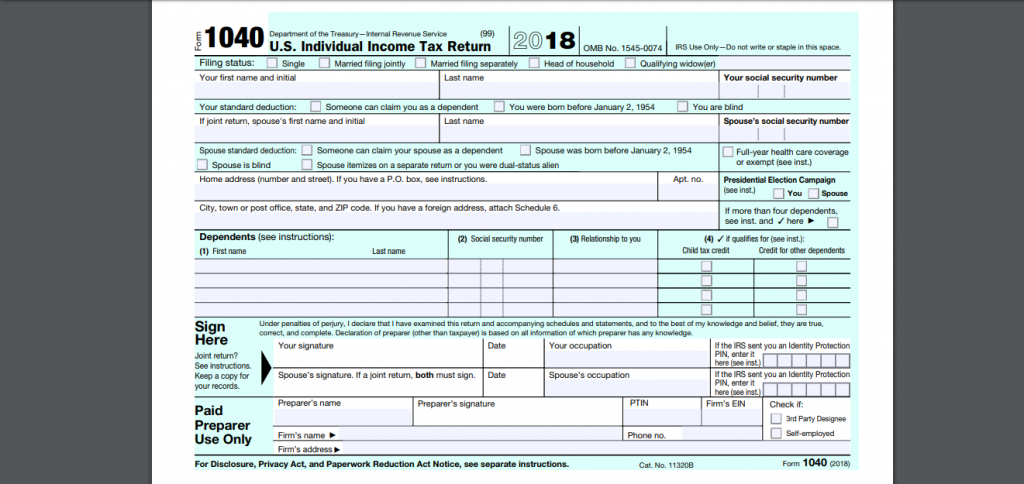

- Form 1040. This is the form you need to submit for filing your U.S. annual federal income tax return regardless of your country of residence and source of income.

Image Source: www.IRS.gov

- Form 2555. If you claim Foreign Earned Income Exclusion (FEIE), this is the form you will need to submit, along with your foreign address, foreign-earned income, employer’s address, and your travel dates to the U.S. within the year.

- Form 1116. This form should only be used by trusts, estates, and individuals to claim Foreign Tax Credit.

You can submit this form so you don’t get taxed twice by reporting accrued or taxes paid to a foreign country and offsetting them against the U.S. tax liability.

Preparing the necessary forms before filing your expat U.S. tax return will help ensure a hassle-free and painless process from your end, and save you possible confusion.

4. You can work with expat tax professionals.

As an American Expatriate, a whole different set of requirements, credits, deductions, exceptions, and tax laws apply to you.

It is possible and doable for you to utilize or benefit from most of these if you’re going to prepare and file your taxes yourself.

However, working with U.S. tax experts, such as Expat Tax Professionals, can save you the possible stress, time, and money that you can go through if you do the filing process.

By hiring tax professionals, you can focus on growing your income and leave the tax filing – and everything that comes with it – in the hands of experts.

For instance, working with specialists will help you file your expat U.S. tax return on time, and walk you through the possible late filing process.

Plus, working with tax professionals can assist you in coming up with strategies to minimize your tax liability using the right tools and software.

Again, you can do your taxes if you have simple returns, but if you own a business, have investments, or rental properties, preparing your return can be a time-consuming task.

That being said, getting help from tax experts with substantial knowledge and experience can bring you the most beneficial outcomes and saves you the hassle of dealing with potentially complicated tax situations.

Bottomline

Filing your U.S. tax return as an expat doesn’t have to be a stressful and complicated time of the year.

By knowing the right steps to take and even getting help from the experts, preparing and filing your tax return will be a pain-free and seamless process.

If you learned from this guide, please share this with your network. Cheers!

Author Profile

- Blogger by Passion | Contributor to many Business Blogs in the United Kingdom | Fascinated to Write Blogs in Business & Startup Niches |

Latest entries

FinanceFebruary 7, 2026The Main Types of Online Fundraising Used by Charities

FinanceFebruary 7, 2026The Main Types of Online Fundraising Used by Charities BusinessJanuary 9, 20266 Fastest Cash House Buyers in the UK 2026

BusinessJanuary 9, 20266 Fastest Cash House Buyers in the UK 2026 BusinessDecember 12, 2025The Smart SME’s Guide to Future-Proofing Physical Assets

BusinessDecember 12, 2025The Smart SME’s Guide to Future-Proofing Physical Assets FinanceOctober 28, 2025How to Measure the ROI of Your Promotional Product Campaigns?

FinanceOctober 28, 2025How to Measure the ROI of Your Promotional Product Campaigns?