Table of Contents

Business owners call for urgent government support in the Chancellor’s pre-election budget on March 6th.

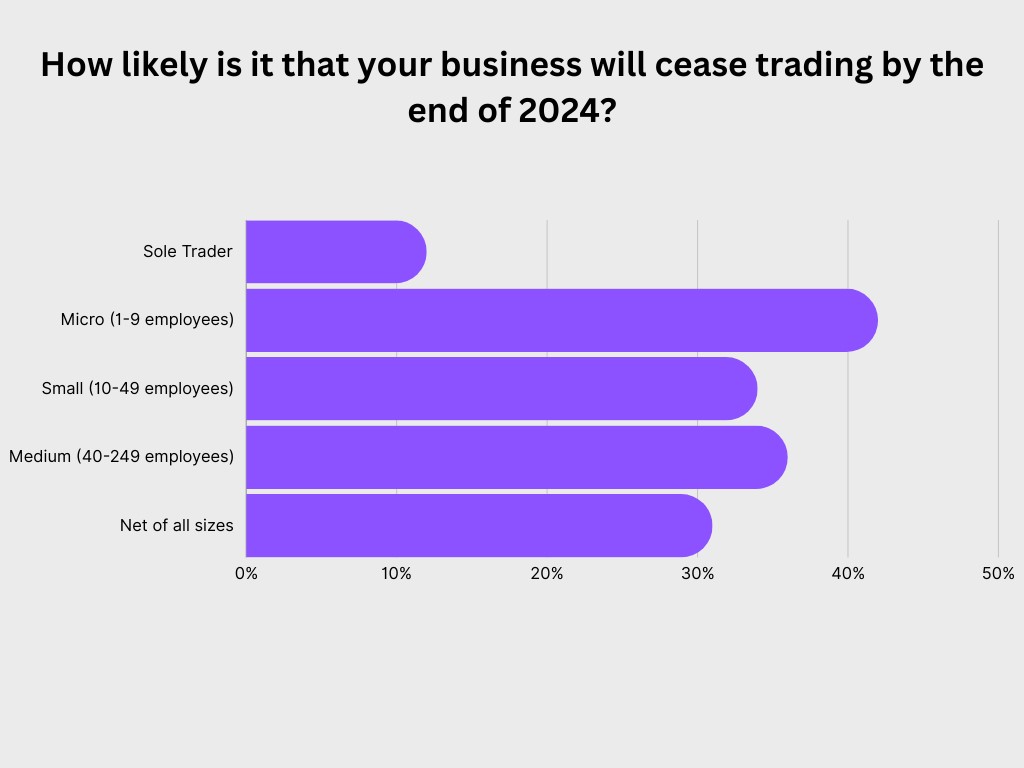

In a recent survey conducted by invoice finance company Novuna Business Cash Flow, involving 500 small and medium-sized enterprises, a startling 31% of business owners anticipate the potential closure of their businesses by the end of 2024. This statistic underscores the significance of the forthcoming Spring budget, positioning it as potentially one of the most critical in recent years.

The prospect of numerous businesses facing closure is sobering, a reality underscored by a recent ONS report, showing just 3% of businesses had temporarily halted trading in February 2024, with only 2% having shut down permanently.

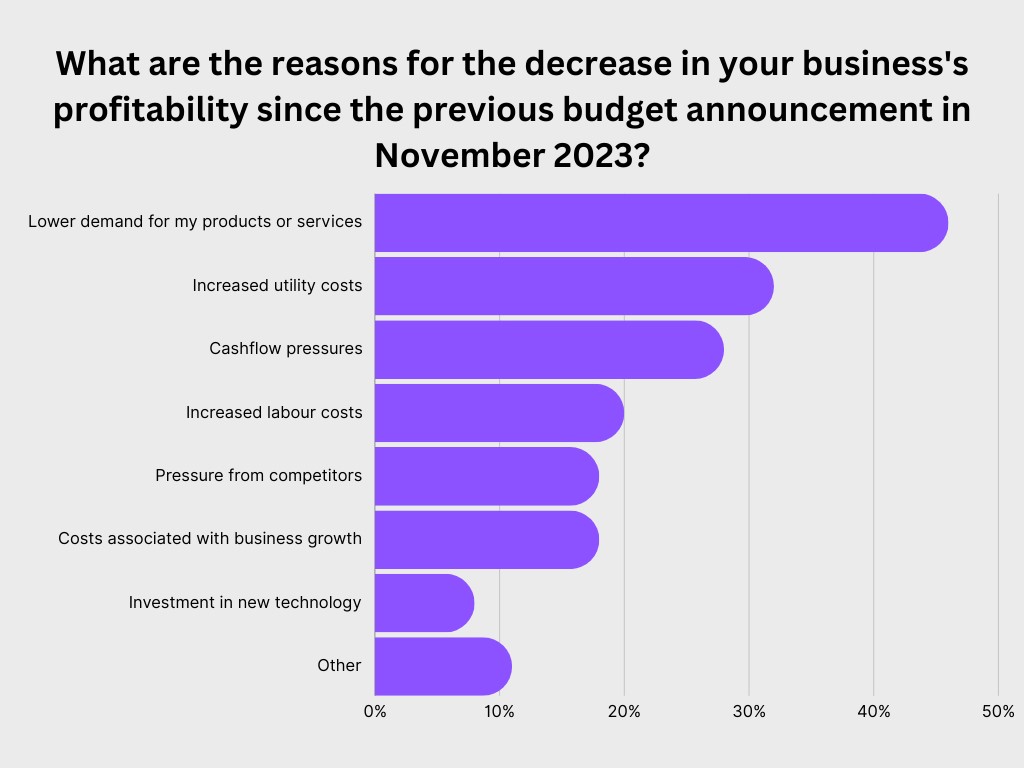

An increase in utility bills a key contributor to the drop in profitability, reported 32% of businesses

The findings also shed light on the challenges leading to potential business closures. Since the last budget announcement in November 2023, a notable 46% of businesses reported a decline in demand for their products or services as the chief cause of reduced profitability. Closely following this, 32% of businesses are wrestling with the burden of increased utility costs, while 28% are navigating through cash flow pressures.

25% of business owners likely to make redundancies by the end of 2024

Despite these challenges, there remains a strong determination among businesses to persevere, with 62% of businesses likely to implement cost-cutting measures to sustain their operations. Nevertheless, such strategies may lead to significant restructuring, including redundancies, which 25% of SMEs anticipate will be necessary by the end of the calendar year.

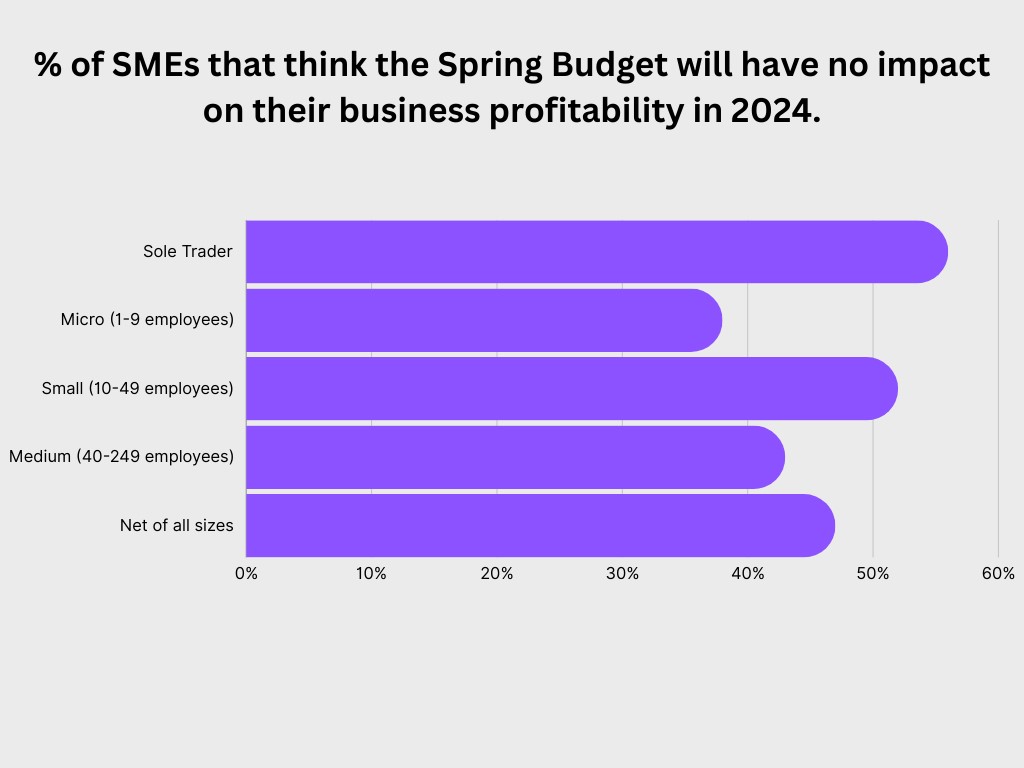

Half of SMEs surveyed believe the upcoming budget will have no impact on their business’s chance of survival

However, the confidence in the government’s ability to address these concerns through the upcoming budget is notably low, with 47% of businesses surveyed expressing scepticism, believing that the government’s plans will have no impact on their current predicaments.

With a significant portion of the business community at risk, the government’s upcoming fiscal policies will not only shape the economic landscape but also signal its commitment to supporting the backbone of the economy. The question remains: will the 2024 Spring budget offer the much-needed support to SMEs, or will it fall short of addressing the critical challenges they face?

John Atkinson, Head of Commercial and Strategy at Novuna Business Cash Flow, commented on the recent survey findings:

“This survey exposes significant concerns among business owners, particularly highlighting that 28% are grappling with cash flow pressures in these challenging economic times. It underscores the urgent need for a budget that truly addresses the needs of small and medium-sized enterprises. As vital pillars of our economy, known for their innovation, employment opportunities, and growth, their struggles emphasise the necessity for government policy to be closely aligned with their real-world needs. The forthcoming budget presents an invaluable chance for the government to show its commitment to supporting SMEs and, by extension, the broader economy.”

For more information, visit Novuna Business Cash Flow’s blog page here.

About the research:

- Field Dates: 9th – 15th February 2024.

- Sample: 500 UK SME decision makers – even split between sole traders, micro (1-9 employees), small (10-49 employees) and medium businesses (50-249 employees).

- Weighting: Weighted to be nationally representative.

- Results based on the following survey questions:

- “Thinking about your business’ performance in 2024, how likely or unlikely is it that your business will cease trading before the end of the year?”

- “You mentioned that your business’ profitability has decreased since November 2023, as compared to the same period last year. Which, if any, of the below describe why? Select all that apply.”

- “Continuing to think about your business’ performance in 2024, which, if any, of the following actions are you likely to take before the end of the year? Select all that apply.”

- “The upcoming Spring Budget is due to be presented by the Chancellor of the Exchequer on 6th March 2024, outlining further tax and government spending changes. What impact do you think the Spring Budget will have on your business profitability in 2024?”

- More details of this survey can be provided upon request.

This press release is based on a survey conducted by Novuna Business Cash Flow, involving 500 SMEs, to assess their outlook in anticipation of the Spring 2024 budget.

For more business news head here.

Author Profile

- Passionate content creator, contributor, freelance writer and content marketing allrounder.

Latest entries

Business TipsJanuary 28, 2026Gamification in Business: How unique 2D Art Boosts Conversions

Business TipsJanuary 28, 2026Gamification in Business: How unique 2D Art Boosts Conversions Business TipsJanuary 8, 2026The Hidden Pitfalls Of Selling A Business

Business TipsJanuary 8, 2026The Hidden Pitfalls Of Selling A Business FeaturedJuly 31, 2025How Directors Can Earn £1,000 Tax-Free From Their Own Company

FeaturedJuly 31, 2025How Directors Can Earn £1,000 Tax-Free From Their Own Company FeaturedMay 28, 2025Government Unveils Major Crackdown on Tax Avoidance – Up to £6.5 Billion Could Be Reclaimed by 2029

FeaturedMay 28, 2025Government Unveils Major Crackdown on Tax Avoidance – Up to £6.5 Billion Could Be Reclaimed by 2029