Table of Contents

Futures trading is a popular form of investment that allows traders to speculate on the price movements of commodities, currencies, and financial instruments.

One of the key goals for futures traders is to maximise their returns, but achieving this requires a deep understanding of the market and the implementation of effective strategies. In this article, we will explore some key strategies that traders can use to maximise their returns in futures trading.

One such platform, https://immediate-access.org/, offers a user-friendly interface and a wide range of trading tools and resources to help traders make informed trading decisions.

Understanding Futures Trading

Before delving into specific strategies, it is important to understand the basics of futures trading. A futures contract is a standardised agreement to buy or sell a specified asset at a predetermined price on a specified date in the future. Futures trading offers several advantages, including leverage, liquidity, and the ability to hedge against price fluctuations.

Compared to other forms of trading, such as stocks or options, futures trading involves higher leverage, which means that traders can control a larger position with a relatively small amount of capital. This can amplify both gains and losses, making risk management crucial in futures trading.

Risk Management Strategies

Effective risk management is essential for maximising returns in futures trading. One of the key strategies for managing risk is the use of stop-loss orders, which are orders placed to automatically sell a futures contract if the price falls to a certain level. This helps limit potential losses.

Effective risk management is essential for maximising returns in futures trading. One of the key strategies for managing risk is the use of stop-loss orders, which are orders placed to automatically sell a futures contract if the price falls to a certain level. This helps limit potential losses.

Another important strategy is diversification, which involves spreading your investment across different assets to reduce the impact of any single asset’s price movement on your overall portfolio. Diversification can help protect against large losses in case of adverse market conditions.

Technical Analysis

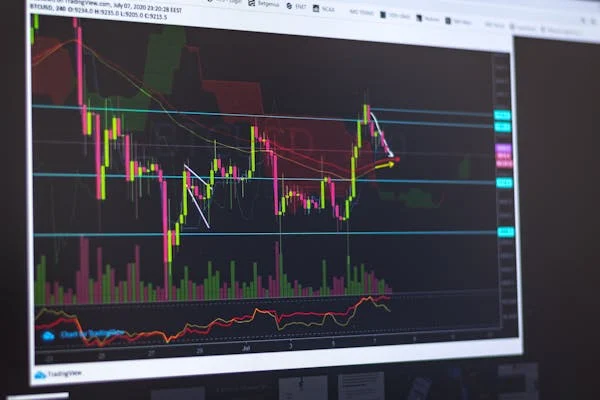

Technical analysis is a popular tool used by futures traders to analyse price movements and identify potential trading opportunities. It involves studying historical price charts and using various technical indicators to forecast future price movements.

Common technical indicators used in futures trading include moving averages, relative strength index (RSI), and stochastic oscillators. Traders use these indicators to identify trends, support and resistance levels, and entry and exit points for their trades.

Fundamental Analysis

Fundamental analysis involves analysing economic, financial, and other qualitative and quantitative factors that can affect the price of futures contracts. This includes factors such as supply and demand dynamics, geopolitical events, and economic indicators.

Traders use fundamental analysis to make informed trading decisions based on the underlying factors driving the market. For example, if there is a forecasted increase in demand for a commodity due to a supply shortage, traders may choose to buy futures contracts for that commodity to profit from the expected price increase.

Trading Psychology

Trading psychology plays a crucial role in determining a trader’s success in futures trading. Emotions such as fear, greed, and overconfidence can cloud judgement and lead to impulsive trading decisions. To maximise returns, traders must learn to control their emotions and stick to their trading plans.

Common psychological pitfalls to avoid include chasing losses, overtrading, and holding onto losing positions in the hope that they will turn around. By maintaining discipline and emotional control, traders can avoid these pitfalls and make more rational trading decisions.

Advanced Strategies for Maximising Returns

In addition to the basic trading strategies mentioned above, there are several advanced strategies that traders can use to maximise their returns in futures trading. One such strategy is spread trading, which involves simultaneously buying and selling related futures contracts to profit from the price difference between them.

Another advanced strategy is using options on futures, which gives traders the right, but not the obligation, to buy or sell a futures contract at a predetermined price. Options can be used to hedge against price fluctuations or to speculate on future price movements with limited risk.

Traders can also leverage market trends and cycles to maximise their returns. By identifying long-term trends and trading in the direction of those trends, traders can increase their chances of success. Similarly, by understanding market cycles and adjusting their trading secrets and strategies accordingly, traders can capitalise on recurring patterns in the market.

Conclusion

Maximising returns in futures trading requires a combination of knowledge, skill, and discipline. By understanding the basics of futures trading, implementing effective risk management strategies, using technical and fundamental analysis, and maintaining emotional control, traders can increase their chances of success. Additionally, by exploring advanced strategies such as spread trading, options trading, and leveraging market trends, traders can further enhance their returns. By continuously educating themselves and adapting to changing market conditions, traders can maximise their returns and achieve success in futures trading.

Author Profile

- Passionate content creator, contributor, freelance writer and content marketing allrounder.

Latest entries

Business TipsJanuary 28, 2026Gamification in Business: How unique 2D Art Boosts Conversions

Business TipsJanuary 28, 2026Gamification in Business: How unique 2D Art Boosts Conversions Business TipsJanuary 8, 2026The Hidden Pitfalls Of Selling A Business

Business TipsJanuary 8, 2026The Hidden Pitfalls Of Selling A Business FeaturedJuly 31, 2025How Directors Can Earn £1,000 Tax-Free From Their Own Company

FeaturedJuly 31, 2025How Directors Can Earn £1,000 Tax-Free From Their Own Company FeaturedMay 28, 2025Government Unveils Major Crackdown on Tax Avoidance – Up to £6.5 Billion Could Be Reclaimed by 2029

FeaturedMay 28, 2025Government Unveils Major Crackdown on Tax Avoidance – Up to £6.5 Billion Could Be Reclaimed by 2029