The UK tax system is designed to collect more tax as income rises. On paper, that sounds fair, those who earn more contribute more.

But in recent years, a hidden force known as fiscal drag has quietly reduced the spending power of millions of workers.

Many people wonder:

“If my salary increased, why do I still feel worse off?”

The answer often lies not just in inflation, but in how tax thresholds work or more importantly, how they don’t change.

Let’s break it down in simple terms.

How Does the UK Personal Tax System and Fiscal Drag Affect Your Take-Home Pay?

How the UK Personal Income Tax System Works?

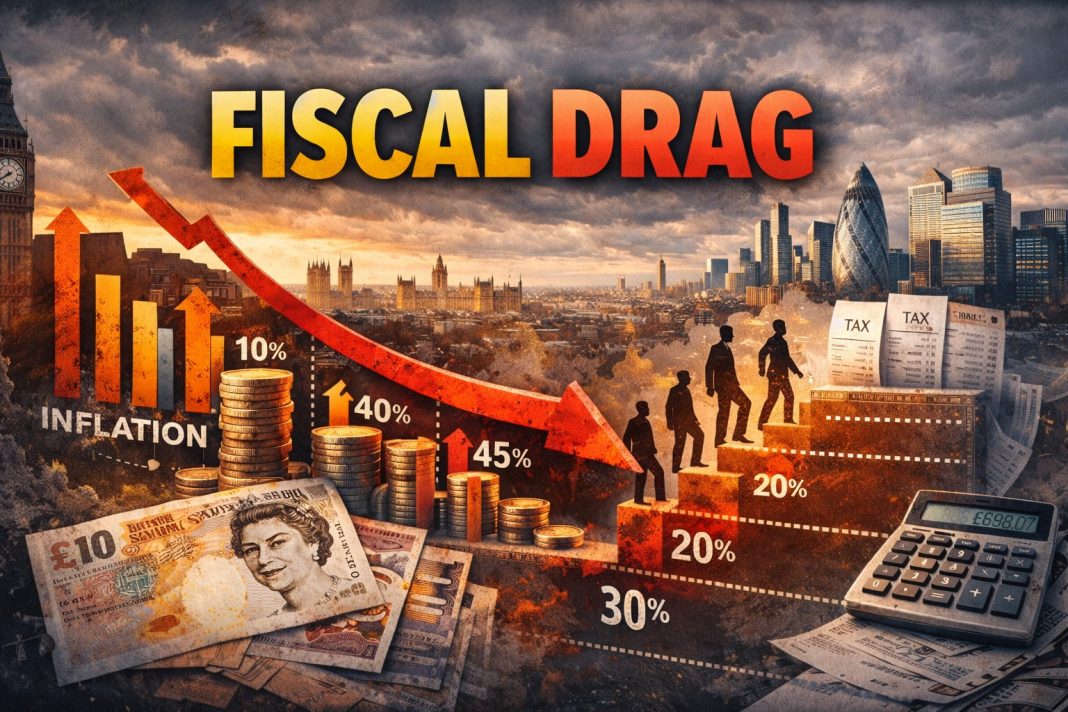

In the UK, individuals pay Income Tax based on tax bands. Each band applies a different tax rate depending on how much you earn.

Key parts of the system include:

- Personal Allowance: The amount you can earn before paying income tax.

- Basic Rate Band: Taxed at 20%.

- Higher Rate Band: Taxed at 40%.

- Additional Rate Band: Taxed at 45%.

The idea is progressive taxation, higher earnings face higher percentages.

But this system only works fairly when tax thresholds move in line with real economic conditions.

What Is Fiscal Drag?

Fiscal drag happens when:

- Salaries increase due to inflation or cost-of-living pressures

- But tax thresholds stay frozen.

When thresholds don’t rise, more of your income becomes taxable, even if your real purchasing power hasn’t improved.

This creates a silent tax increase without changing the tax rates themselves.

Think of it like this:

- Your salary rises by 5% because prices increased.

- The tax-free allowance stays the same.

- You pay more tax even though you’re not actually richer.

Why Frozen Tax Thresholds Matter?

Inflation means everyday costs, housing, food, travel, energy, increase. Employers often raise wages just enough to help workers cope.

But if tax thresholds remain unchanged:

- A bigger portion of income moves into taxable brackets

- Some workers are pushed into higher-rate tax bands

- Net take-home pay grows slower than living costs

The result?

People feel poorer despite earning more.

A Simple Real-World Example

Imagine someone earning £30,000 per year.

- Due to inflation, their salary increases to £33,000.

- The personal allowance remains frozen.

Although their pay increased, they now pay tax on a larger slice of income.

If the tax-free allowance had risen with inflation, their tax burden would stay similar. But because it didn’t, they effectively pay more without any real improvement in lifestyle.

This is fiscal drag in action.

How Fiscal Drag Reduces Spending Power?

Fiscal drag has wider economic effects beyond individual tax bills.

1. Lower Disposable Income

More tax means less money left after essentials. Households cut spending, which affects retail, hospitality, travel, and services.

2. Bracket Creep

Workers slowly move into higher tax brackets over time, not because they became wealthier, but because inflation pushed wages upward.

3. Hidden Tax Increases

Governments can raise revenue without officially increasing tax rates. Many economists call fiscal drag a “stealth tax”.

Why Tax Thresholds Matter During Inflation?

Ideally, when wages rise due to inflation:

Tax thresholds should increase too.

This keeps the tax burden stable relative to real income.

If thresholds track inflation:

- Workers maintain similar take-home pay levels.

- Spending power remains balanced.

- Economic growth stays healthier because people continue spending.

Without adjustments, fiscal drag gradually squeezes the middle class the hardest, especially professionals moving toward higher-rate tax bands.

The Psychological Impact: Why People Feel Stuck?

One of the biggest frustrations people express today is:

“I earn more than I used to, but I don’t feel better off.”

Fiscal drag plays a huge role here.

Salary increases may look good on paper, but once inflation and higher taxation are factored in, real wealth growth slows down.

This leads to:

- Reduced savings capacity

- Less investment into businesses or personal development

- Increased reliance on credit or debt

What Could Change?

Economists and financial experts often suggest several solutions:

- Index tax thresholds to inflation automatically

- Adjust personal allowance regularly

- Increase transparency around real tax increases caused by frozen thresholds

These adjustments help maintain fairness and prevent wage growth from being quietly absorbed by the tax system.

Final Thoughts: Why Fiscal Drag Matters More Than Ever?

The UK personal tax system isn’t just about tax rates, it’s about how thresholds evolve over time.

When income rises but tax bands stay frozen:

- More people pay higher taxes

- Disposable income shrinks

- Economic pressure increases on households

Fiscal drag is subtle, but powerful. It explains why many workers feel like they are running harder just to stay in the same financial position.

Understanding how it works helps individuals plan better, negotiate salaries smarter, and make more informed financial decisions in an inflation-driven economy.

Author Profile

- I'm the CEO of ClickDo Ltd. and SeekaHost- I help the business grow online with latest SEO services & digital marketing strategies.

Latest entries

BusinessFebruary 20, 2026Director’s Loan Account UK Guide: How Smart Directors Use DLA Tax Rules to Build Cash Flow & Grow Their Business?

BusinessFebruary 20, 2026Director’s Loan Account UK Guide: How Smart Directors Use DLA Tax Rules to Build Cash Flow & Grow Their Business? FinanceFebruary 20, 2026Understanding the UK Personal Tax System and Fiscal Drag: Why Many People Feel Poorer Even When Their Salary Goes Up?

FinanceFebruary 20, 2026Understanding the UK Personal Tax System and Fiscal Drag: Why Many People Feel Poorer Even When Their Salary Goes Up? Business StrategiesFebruary 25, 2021How to Start A Business In The UK (10 Steps to Starting & Build A Company)

Business StrategiesFebruary 25, 2021How to Start A Business In The UK (10 Steps to Starting & Build A Company) EntrepreneurshipMay 27, 2019How to get business visa for UK (What you must know about UK Entrepreneur visas)

EntrepreneurshipMay 27, 2019How to get business visa for UK (What you must know about UK Entrepreneur visas)