Table of Contents

High-frequency trading (HFT) is a type of algorithmic trading that employs advanced technology and complex algorithms to execute a large number of orders at extremely high speeds. HFT firms use powerful computers to identify and capitalize on small price discrepancies in the market, often executing transactions within milliseconds or even microseconds.

The popularity of HFT has grown exponentially in recent years, with some estimates suggesting that it accounts for over 50% of all equity trades in the United States. If you’re interested, check HFT brokers here to get you started.

Advantages of High-Frequency Trading

There are several advantages of high-frequency trading to financial markets. First, HFT can enhance market liquidity by narrowing bid-ask spreads and facilitating price discovery. This increased liquidity can lead to lower transaction costs for retail and institutional investors alike.

Second, HFT can contribute to more efficient markets by quickly incorporating new information into asset prices, thereby reducing arbitrage opportunities.

Disadvantages of High-Frequency Trading

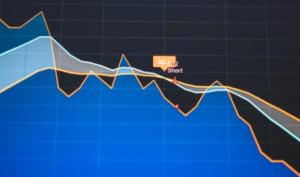

However, high-frequency trading also has its fair share of disadvantages. Critics argue that HFT can exacerbate market volatility, as demonstrated in the infamous 2010 Flash Crash when the Dow Jones Industrial Average plunged nearly 1,000 points within minutes before recovering most of its losses.

Additionally, concerns have been raised about the potential for HFT firms to engage in predatory trading practices, such as front-running or quote-stuffing, which can disadvantage other stock market participants.

Assets Traded and Impact on Market Volatility

High-frequency trading typically involves trading various types of assets, including equities, futures, options, and foreign exchange. The speed at which these transactions occur can impact market volatility in several ways.

For instance, HFT firms may engage in momentum trading strategies that amplify price movements, leading to sudden and sharp fluctuations in asset prices.

Regulating High-Frequency Trading

In weighing the pros and cons of HFT, it is crucial to consider its potential benefits and risks. While high-frequency trading can contribute to increased market liquidity and efficiency, it may also exacerbate volatility and create an uneven playing field for other market participants.

As such, regulators should aim to strike a balance between fostering innovation in the financial industry and safeguarding the stability and integrity of markets. To this end, regulatory authorities around the world have taken various steps to oversee high-frequency trading.

These measures include implementing circuit breakers to halt trading during periods of extreme volatility, imposing minimum resting times for orders, and requiring HFT firms to maintain adequate risk controls.

In conclusion, high-frequency trading is a double-edged sword for the financial markets. While it brings about increased efficiency and liquidity, it also poses risk management. By striking the right balance, high-frequency trading can remain a key component in the ever-evolving financial industry landscape.

Author Profile

- Guest Blogger & Outreach Expert - Interested in Writing Blogs, Articles in Business Niche | News Journalist By Profession in the United Kingdom

Latest entries

BusinessFebruary 17, 2026Why Online Shops Need a Fulfilment Centre?

BusinessFebruary 17, 2026Why Online Shops Need a Fulfilment Centre? LawJanuary 9, 2026Emily Windsor On The Judgment Calls Barristers Make Daily

LawJanuary 9, 2026Emily Windsor On The Judgment Calls Barristers Make Daily TravelJanuary 7, 2026Key Considerations When Installing Temporary Barriers for Roadworks

TravelJanuary 7, 2026Key Considerations When Installing Temporary Barriers for Roadworks BusinessNovember 21, 2025A Practical Guide to Using LMS Platforms for Better Onboarding

BusinessNovember 21, 2025A Practical Guide to Using LMS Platforms for Better Onboarding