Whether you’re a small business owner or just a mere freelancer, invoicing is an essential part of your financing.

More specifically, invoices usually represent how you get paid. They’re a small part of your overall financial activities but an important one nonetheless.

They help improve your cash flow statement. In other words, they allow you to get paid faster and how you manage them says a lot about your overall financial situation.

The traditional definition of an invoice is as follows: “An invoice is a legally-binding document (assuming both sides have agreed to the payment and other terms) that a supplier sends to the buyer after the goods or services have been provided.”

Simple, right?

Though it might be so on paper, it’s still a process many entrepreneurs and businesses often struggle with.

Why is that?

Well, let’s look at some of the common issues associated with manual paper invoicing:

- It’s slow – physically routing invoices typically take up to three days (in addition to the whole process).

- They’re prone to errors – filing and editing paper invoices can be a manual and a tedious process, often suspect to human mistakes.

- They’re difficult to monitor and track – paper invoices can get lost very easily. And unless they’re stored in the right place, chances are, they’ll get lost in the sea of other papers.

Thankfully, now that we’re in the digital era, electronic invoices are slowly taking over and soon, paper invoices will be obsolete.

Until now, there were approximately 36 billion electronic invoices sent worldwide in 2017 with an annual growth rate of 10-20%.

No doubt, E-invoicing is the future of any business.

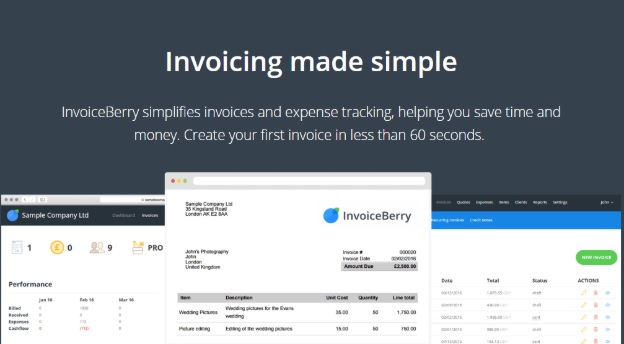

Handling your finances and the invoicing process as an entrepreneur or a small business owner is hard as is. And this is where InvoiceBerry comes in.

Over at InvoiceBerry we believe that the future of invoices is electronic and meant to save you time.

Here are 3 simple but effective ways InvoiceBerry can help your business save time and get paid faster:

1. Designed with simplicity

At its core, InvoiceBerry was designed to act as an online invoicing software solution that’s simple to use and easy to set up.

If you’re a small business and need an invoicing solution, then you want something that is quick and easy to use so you don’t waste too much time learning how to use the software.

This is especially the case when you have multiple employees in your organization who will also be using the same software. You don’t want to be held back by a system that requires to train your staff every time you hire someone new.

This is the niche InvoiceBerry fits in.

Running a startup is a challenge on its own, especially managing its finances. Why make things harder than they should be?

In our research, we found that one of the biggest obstacles small businesses face has to do finances (more specifically, fiscal awareness and obtaining capital).

Your financial situation can make or break your business. It’s essential you stay on top of it with the right online invoicing solutions, a proper budgeting system, and an easy-to-use payroll software as a way to track all your cash inflows and outflows.

Now, depending on your requirements and budget as a business – your answers will probably vary. But at the end of the day, one common thread that all of them should have is simplicity, adaptability, and flexibility.

InvoiceBerry hits all those checkmarks.

It was designed in a manner to make a seemingly complex area (invoicing and finances) simple and easy to set up so that you don’t waste time learning the ins and outs of a complicated accounting software. It’s uncomplicated and quick for anyone to learn how to generate professional looking invoices in a matter of seconds, even if they don’t come from an accounting background.

This is what really differentiates the software from others at the end of the day.

Time is a scarce commodity as a startup. InvoiceBerry knows what that’s like and helps you save it as much as you can to be successful.

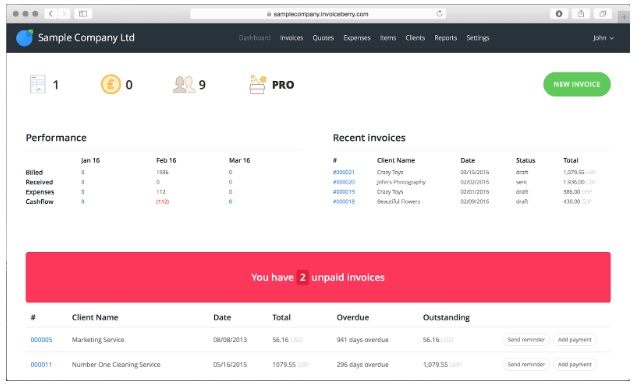

2. Tracking, managing, and organizing

Once you get in the habit and get an overall sense of what your financial situation looks like, the next step is making sure everything is scalable and sustainable.

How do you achieve this, exactly?

Through proper planning, management, and organization.

In other words: what gets measured gets managed.

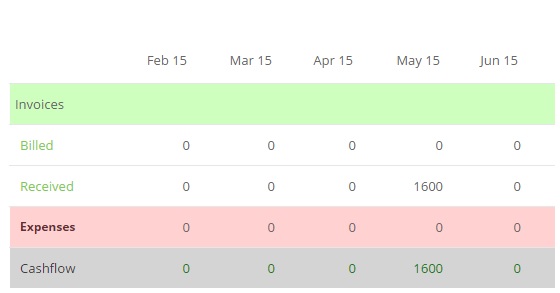

This is especially true in the world of finances. There are many financial indicators you might want to track, but the bottom line is that you want to have more cash inflows than cash outflows to continue operating.

As an SMB, keeping track of your finances is a sure way to determine if you’re on the right track, in terms of your finances, sustainability, and overall success.

And how do you do this?

Typically, you set clear and distinct SMART (specific, measurable, attainable, relevant, timely) goals and follow them based on your requirement, business, and so on.

Depending on your goals, you can then measure and track the specific key indicator accordingly.

But it’s hard to generalize financial KPIs as each of them has a different intent.

So, what’s the solution?

Because accounting is a complex and a tough world to get into, you might want to consider adopting accounting software to boost your business and get rid of manual bookkeeping.

Keeping track of your finances is a vital step as a business owner. You need to know for a fact how much you’re making and how much you’re spending if you want to survive the month.

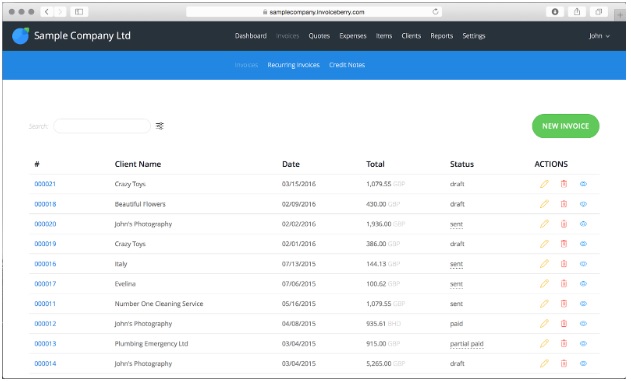

Online invoicing is a great way to see which invoices you’ve already sent, which are ones are still unpaid, your drafts, templates, and more.

When it comes to tracking and analytics, InvoiceBerry offers actionable reports, tracking your inventory, and keeps all your data and information secure in a single location.

What this means is that you can review, reprint, and resend invoices if needed, get a monthly report of your situation to get a clear picture of your costs and revenue, and more.

This can help you calculate profits more easily and learn which customers generate the most revenue for your company.

In short, these reports can help you make smart decisions, and operate your business more efficiently and productively.

3. A focus on the entrepreneur

Finally, what makes InvoiceBerry really stand from our competition has to do with the fact that we really hone in and focus on the entrepreneurial needs.

Being an entrepreneur is hard work.

It’s no surprise that most businesses and startups fail. We’ve all heard the magical number that 9 out of 10 startups fail.

According to research – 46% of businesses fail due to incompetence, 30% due to unbalanced experience or lack of managerial experience.

Essentially, most startups fail because of their owners.

No matter how good your idea or sales pitch is, just one simple mistake on any stage of the business can ruin your whole business.

Before looking at any other causes, you should first take a long look at yourself and evaluate your skills and overall judgment.

The most common resason why small businesses fail include:

- The absence of personal skills, business product or service issues.

- Inadequate business planning (or lack thereof).

- Ineffective marketing.

- Failure to track finances.

InvoiceBerry focuses on the last one.

If you don’t keep a careful record of all the money that comes in and out, you risk going out of business or even getting into serious debt.

Regardless of your niche or industry, you need to be keeping track of and analyzing your overall financial status of your business so you can survive.

And when there’s so many other things you need to be taking care of – this can be somewhat challenging.

There’s always a lot at stake as an entrepreneur, and only so little time.

At the end of the day, InvoiceBerry helps you save time and spend less of it creating and sending invoices (when you can automate that whole process), and instead – focus on the things you love. For improved invoicing, try Zintego Invoice Generator.

Conclusion

In conclusion, running a business is a hard enough task on its own.

From marketing to operating to sales, there is always so much to do with so little time.

All this, while handling your finances and making sure you don’t go broke.

The last part is most important.

Because, as we all know, finances can be an extremely intimidating chapter for most startups and aspiring entrepreneurs.

If you’re looking to simplify that whole process and gain an edge above your competitors, then you might want to consider implementing the right invoicing and accounting software in your business.

Creating your first invoice takes less than 60 seconds, and from there on – you’re well on the path of tracking expenses and generating monthly reports of your financial situation.

Invoices are a small part of your finances but an important one in that they bring cash inflows to your business.

When you’re just starting up, you need to make sure you have the whole payment process down to a tee and know what you’re doing.

Author Profile

- Uwe is the founder of online invoicing software Invoiceberry. Small businesses and sole traders can create, send and manage their invoices, quotes and credit notes with the tool or use the free invoice templates to get started. In his free time Uwe travels the world and enjoys experiencing different cultures.